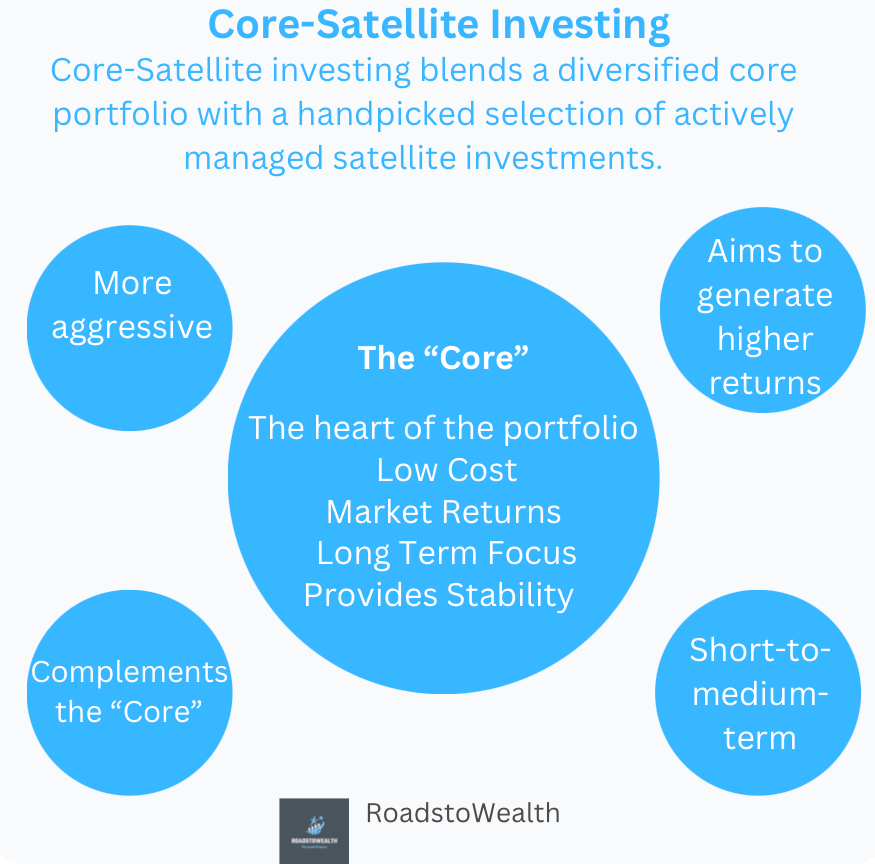

What is the Core-Satellite Strategy?

The core-satellite investment approach is a strategic investment methodology that incorporates a diversified core portfolio, typically comprising index funds for comprehensive diversification, alongside selectively chosen satellite investments, often involving individual stocks (or other specific ETFs that focuses in a specific sector or dividends) to leverage potential higher returns. This approach finds favor among investors due to its adept balancing of risk and reward dynamics.

Why Use the Core-Satellite Approach?

The core-satellite approach is favored for its ability to strike a balance between risk and reward in investment portfolios. Here are some key reasons why investors choose to adopt this approach:

Diversification: The core of the portfolio, often composed of index funds or other diversified assets, provides broad exposure across various market segments. This diversification helps spread risk and reduces the impact of poor-performing individual investments.

Risk Management: By including a core of stable, diversified investments, investors can manage overall portfolio risk. This is crucial for maintaining stability, especially during volatile market conditions.

Potential for Higher Returns: The satellite investments, which may include individual stocks or other actively managed assets, introduce the potential for higher returns. While these investments carry more risk, they offer an opportunity to enhance overall portfolio performance.

Flexibility: The core-satellite approach allows for adaptability in investment strategies. Investors can adjust the allocation between core and satellite components based on market conditions, their risk tolerance, and investment objectives.

Active Management: The strategy allows for active management of a portion of the portfolio. This can be appealing to investors who want to take advantage of market trends, capitalize on specific opportunities, or align their investments with particular themes.

Alignment with Investment Goals: Investors with specific financial goals or preferences may find the core-satellite approach aligns well with their objectives. It offers a structured framework for achieving a balance between stability and potential growth.

My ROTH IRA Core-Satellite Dividend Strategy

Within my ROTH IRA, I'll be employing the core-satellite strategy with a focus on dividend growth. This strategic approach aims to build a source of income that I can eventually rely on to replace my salary when I decide to retire at the age of 60. The added perk? Since this is within my ROTH IRA, I can relax as there won't be any concerns about paying taxes on my dividends!

I've chosen SCHD and DGRO as my core ETFs, and for satellites, I'll include SCHG and SCHY (following a similar methodology as SCHD but for international exposure). Additionally, I may incorporate some individual stocks and possibly JEPI/Q.

If you're not sure where or how to invest, maybe take a look at the core-satellite strategy and see if it fits your goals for investing. Make sure to sign-up to keep up with my investments as I continue on the path of financial freedom.

Comments